The Carbon Border Adjustment Mechanism (CBAM) will be officially implemented in 2026 and will gradually expand its scope

- Share

- Issue Time

- Jan 5,2026

Summary

CBAM will enter its formal implementation phase in 2026, preceded by a transitional period from 2023 to 2025. This gradual implementation arrangement aligns with the phasing out of free allowances in the European Union Emission Trading Scheme (EU ETS), supporting the decarbonization transformation of EU industries.

1. Background introduction of Carbon Border Adjustment Mechanism (CBAM)

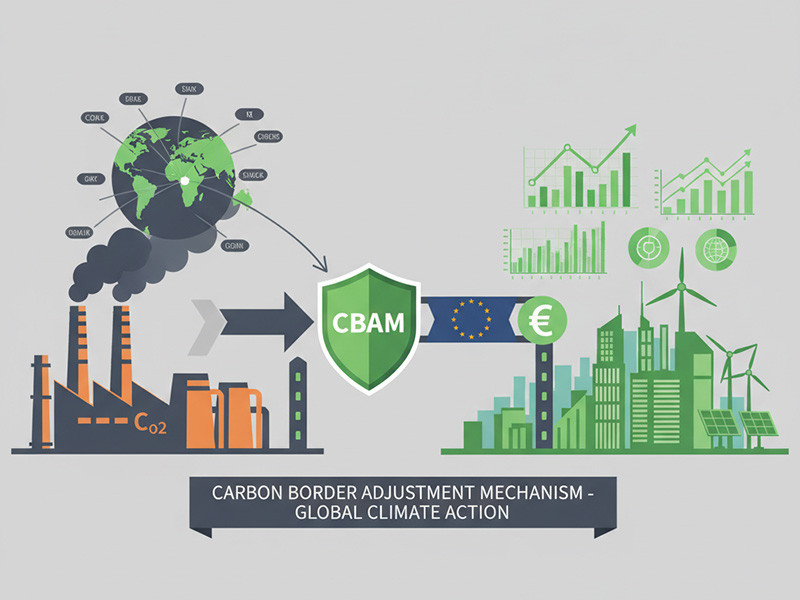

The Carbon Border Adjustment Mechanism (CBAM) is a policy tool developed by the European Union to establish a fair carbon price for high-carbon-emitting products entering the EU market. Its primary objective is to prevent "carbon leakage" and encourage non-EU countries to adopt cleaner industrial production practices.

CBAM will enter its formal implementation phase in 2026, preceded by a transitional period from 2023 to 2025. This gradual implementation arrangement aligns with the phasing out of free allowances in the European Union Emission Trading Scheme (EU ETS), supporting the decarbonization transformation of EU industries.

2. CBAM will be officially launched on January 1, 2026

The system will be launched on 1 January, 2026, and EU importing enterprises are required to complete their applications by 31 March, 2026. Importers of cement, steel, aluminum, and fertilizer exceeding 50 tons in the EU, as well as all importers of electricity or hydrogen, must have submitted their applications or obtained authorization at the time of import. Importers who have not yet submitted their applications must take immediate action, otherwise they will face the risk of customs clearance being blocked, delayed, or penalized.

3. From 1 January, 2028, CBAM will be extended to cover some downstream products of steel and aluminum-intensive industries

To prevent "emission transfer" rather than "emission reduction", the European Commission plans to expand the scope of application of the Carbon Border Adjustment Mechanism (CBAM) to 180 categories of downstream products that are intensive in steel and aluminum, including machinery and equipment, household appliances, and so on.

4. Tianjin Youfa Internation Trade Co., Ltd actively cooperates with EU importers to obtain CBAM certificate

CBAM mainly imposes carbon costs on the "implicit carbon emissions" of specific industry products imported into the EU, such as steel, aluminum, cement, electricity, fertilizers, hydrogen, etc. Steel products (including steel pipes) are one of the first industries covered by CBAM.

Tianjin Youfa Internation Trade Co. can provide direct and indirect carbon emission data during the product production process, and cooperate with EU importers to purchase CBAM certificates to cover their carbon emission costs.